Related: This article was excerpted from the June 2021 InterMarket Review. For more information, please click here.

This chart shows gold adjusted for the CPI, or put another way, gold as an inflation hedge. As you can see, it’s currently below massive resistance in the form of 1980-2021 horizontal trendline. There is a good chance that it can power through as the price has recently been given a boost. That arrived in April in the form of a strong CPI number which has resulted in a drop in real interest rates.

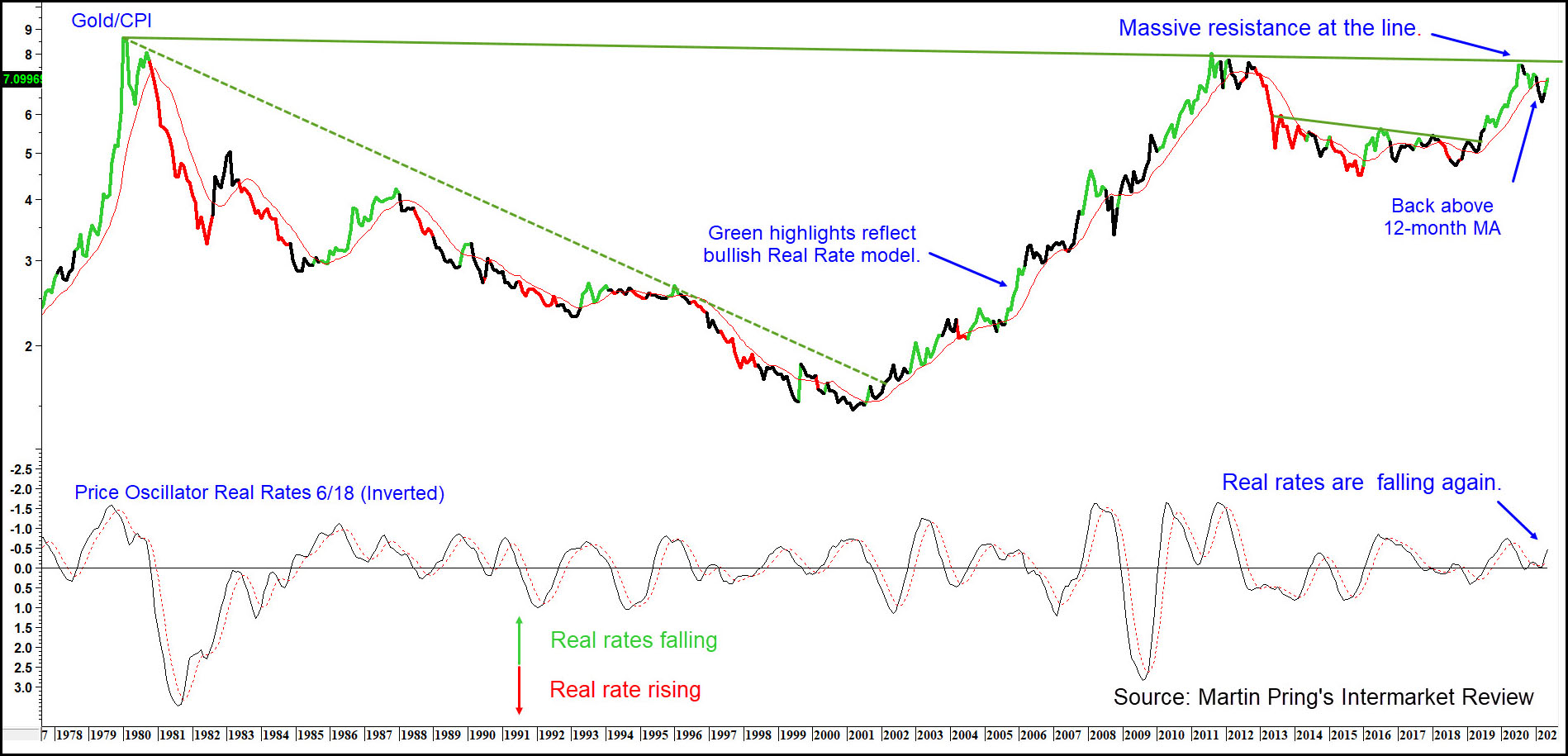

Chart 1 — Gold/CPI and an Inverted 6/18 Price Oscillator of Real Rates

Historically, the price of the yellow metal has thrived in an environment of falling inflation adjusted real interest rates and suffered under a rising one. A declining trend in real rates is defined as a period when the 6-month MA of the CPI adjusted 10-year yield is below its 18-month counterpart. This relationship has been plotted in oscillator format in the lower window of the chart. Please note it has been plotted inversely, so a rising oscillator indicates falling rates and vice versa. Consequently, bullish signals show up as a positive zero crossover. In order to earn a green highlight, it’s necessary for these positive signals to be supported by gold itself reacting in a positive way by trading above its 12-month MA. Red highlights reflect the opposite set of conditions and black a conflict between the two components. Real rates went positive for gold in April, but May’s action has triggered a green highlight because the price is now back above its 12-month MA.

This model doesn’t tell us the magnitude or duration of the expected rise, only that the current environment is positive for gold prices. If it produces enough energy to propel the price above that 40-year resistance trendline, the breakout will signify that a multi-year rise in gold prices is likely. Since gold discounts industrial commodity prices, such action would also be positive for them and not so good for bond prices, which abhor inflation.

Related: This article was excerpted from the June 2021 InterMarket Review. For more information, please click here.