Diversification is not only one of the simplest and most logical principles for consistent investment success, but an important one as well. Perhaps this concept is so often overlooked by individual investors because of its simplicity in an otherwise complex world.

The justification for diversification rests partly on the factor of chance and partly on protection in the event that our analysis, heaven forbid, should turn out to be incorrect. The purchase of one security or even a portfolio limited to one asset class runs the risk of exposure to an unforeseen or unforeseeable event that could cripple an entire investment strategy. It is certainly true that a portfolio containing 25 stocks will increase the risk that

one of them will be adversely affected by a factor of 25, but the odds of the whole portfolio’s being wiped out would also be lessened by that amount.

Diversification is often thought of as a technique for spreading risk, but it is, in fact, much more than that. Just as it protects against unfortunate events, diversification can also increase the odds of good fortune. For example, a portfolio containing 10 or 12 stocks will stand a much better chance of being affected by a generous takeover offer, an unexpected technological breakthrough, a big oil strike, or some other beneficial

development than one containing just two or three issues.

A further advantage is that diversification allows an investor to make gradual changes in a portfolio. For example, market peaks are often confusing affairs as stocks fluctuate in a wide trading band. One by one, the indicators fall into place until an overall bearish picture finally becomes clear. The realization that stocks are in a topping out process is a gradual

one, so it makes sense to shift the portfolio away from stocks in a step-by-step manner, as well. As more factual evidence of a market top is obtained, and individual issues really to prescribed target ranges, the equity allocation will gradually and deliberately be reduced.

The allocation of assets in a number of different categories achieves diversification, but diversification alone does not necessarily guarantee investment success. For example, if a portfolio is split evenly between bonds, stocks, and cash, it could quite easily lose real purchasing value during a long period of inflation. This would happen because the stock

portion, which has traditionally beaten inflation over the long haul, would not be large enough to offset the debilitating effects that inflation would inflict on the fixed income allocation.

Why Diversification is Not Always Practiced

Despite the substantial benefits of diversifying, many investors fail to take advantage of this important and profitable technique. The principal reason stems from the frailty of human nature. The first weakness, which many of us would prefer not to admit, is downright laziness. After all, it is much easier to purchase a stock that has just been painted in glowing terms by a broker or friendly “insider,” than to undertake tedious research on a number of different issues from which the final selection will be made.

In a similar vein, many of us are tempted to buy a particular asset theme. “The Fed is pumping up the money supply, OPEC is cutting oil production, and inflation is coming back; so let’s buy precious metals.” This may be perfectly legitimate investment idea, but does it mean that we should allocate all of our assets to vehicles that provide an inflation hedge? Perhaps our assumptions are just plain wrong, or conceivably these possibilities have already been discounted by the market. In either case, this kind of simplistic one-idea allocation strategy leaves no room for error.

Such situations often arise because an individual’s experience and knowledge are limited. People often extrapolate the failing set of economic conditions well into the future. The fact that circumstances can and do change is often ignored or conveniently glossed over. For example, we may perceive that inflationary conditions are intensifying as a result of the lagged effect of an easy money policy by the Fed. The decision to buy

precious metals may well be the right one, but only for the time being. This trend will not continue indefinitely because the economy possesses its own internal correcting mechanisms. For every action, there is a reaction and every inflation breeds its own deflation as prices rise, so do interest rates. Sooner or later, these higher rates make it unprofitable for businesses and undesirable for consumers to borrow, so the economy turns down. When this occurs, inflation hedge assets suffer. Your portfolio might do well for a time, but by putting all of your eggs into an inflationary basket, the end result will be disappointing.

Intellectual laziness also applies to an investor who chooses to concentrate on one specific investment, usually a stock, that he hopes will turn out to be his financial home run. As a result, he will have very little, if any, emotional capital left to creatively and objectively examine other possible vehicles. Fear can be just as destructive as greed. When the home run fails to materialize, as is inevitably the case, the investor becomes demoralized. In this kind of emotional state, it will be difficult, if not impossible, to make any rational investment decisions. Performance will suffer and some valuable opportunities will be lost.

Diversification involves a certain degree of patience, thought, and discipline. Unfortunately, in this day of instant analysis and news, not to mention unlimited financial leverage, most of us overlook these virtues on our way to what we (incorrectly) believe to be fast and painless financial rewards.

Inflation and Volatility: Two Important Risks

In the final analysis, the two most important risks to a portfolio are volatility (of the rate of return) and inflation. Experience tells us that over the long run, equities have offered a better rate of return than either cash or bonds. However, it is possible to lose a considerable amount of money over the short term if stocks are bought and sold at the wrong time. Bonds are also subject to volatility as interest rates rise and fall, but all bonds

eventually return to par. Even if a bond is purchased at a premium, the interest payments assure a positive overall return if it is held to maturity. Nothing can prevent default or bankruptcy, but, in general, the longer the holding period for either stocks, or bonds, the less important is the volatility risk.

By the same token, inflation is a long-term risk because an environment of rising prices eats away at the purchasing value of the principal. The more substantial the holding period, the greater the loss of purchasing power. Diversification is a useful technique for minimizing both risks. For example, if a portfolio always includes some bonds and equities, the holding period of these core positions is, by definition, a lone one, which greatly reduces the volatility risk.

At the same time, part of the portfolio may also be rotated among specific asset classes as the business cycle unfolds. With this combination, the investor can hedge against inflation at that time of the cycle when it is most threatening and offset some of the long-term risk. In this way, diversification is both a static and a dynamic process.

Diversification can also be used to spread risk for shorter-term periods. For example, you may decide that the outlook for food stocks, in general, is particularly favorable, especially that of Campbell’s Soup. In this instance, you are actually making two bets: one for the industry in general and the other specifically for Campbell’s Soup. It could turn out that you are correct in your analysis of the food industry, but for some reason, Campbell’s Soup runs into difficulties of its own and greatly under-performs other companies in the industry. On the other hand, if you invest in several food stocks, you are still exposed to the industry risk, but the individual company risk is spread out among several issues. Under such circumstances, it is unlikely that this diversification will significantly result in a much higher reward, but it will certainly limit the downside potential, i.e., risk for the investor.

Reducing Risk from Individual Companies (Unsystematic Risk)

The approach of diversifying within an industry group can be taken one step further. We all know that putting your eggs into one basket can lead to trouble if the basket breaks, so it is important from an investment point of view to make sure you diversify your portfolio sufficiently in order to avoid being financially crippled if a specific investment turns bad.

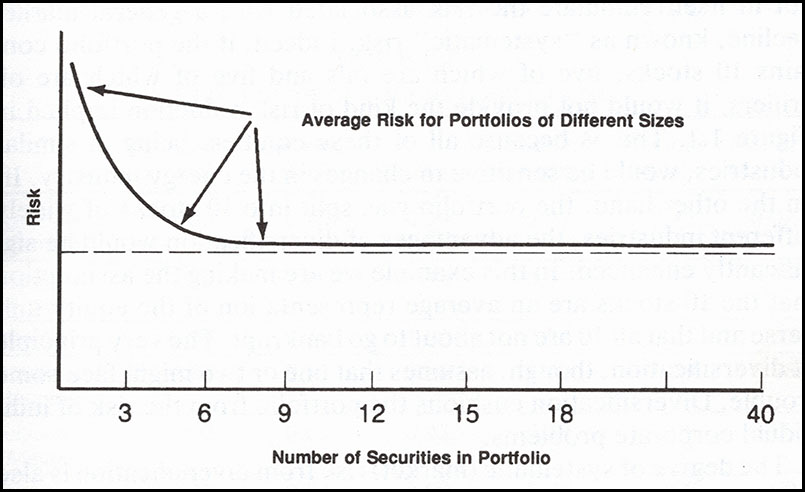

Figure 1.1 — Risk Reduction Through Diversification

Risk associated with individual companies independent of market fluctuations is called “unsystematic” risk. Experts generally agree that risk declines as more stocks are added to a portfolio, but the marginal beneficial effect significantly diminishes as more issues are added. Figure 1.1 indicates that the most substantial reduction in risk comes at the early stages when the second and third stocks are added. The marginal benefits are progressively reduced. By the time the twelfth stock is added, there is very little in the way of risk reduction to be obtained. The curve clearly shows that the more stocks in a portfolio, the less susceptible that portfolio is to the fortunes of one particular company. The curve starts to flatten out after 6 issues are included. After this point has been reached, the incremental reduction of risk becomes noticeably lower. In effect, there is a great advantage in diversifying between 1 and 12 issues, but not much more from 12, to say, 24. Because it takes a lot longer to research 24 companies than 12 companies, the most efficient approach for most individuals in terms of minimizing risk and effort is to limit the stock portion of their portfolio to around 9 to 12 issues because there is little to be gained from additional diversification.

Excerpted from “The All-Season Investor”

Related Article: Diversification: The Medicine for Sleepless Nights, Part 2