Perhaps the least understood principle of trading for those entering the arena for the first time is the concept of risk management. We are all quick to think of profits, but few of us concentrate on losses. Yet, managing losses is the first and most important step we have to take. After all, if you lose your capital you are out of the game. Limiting risk and quickly taking losses will allow you to come back time and time again.

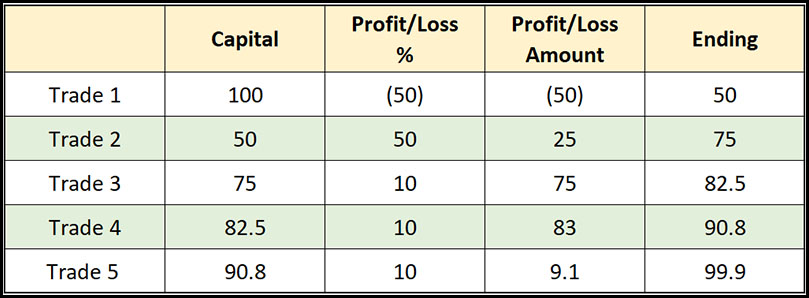

Table 1.1 is very instructive since it shows that recovering from large losses can be very difficult. Here you can see that the starting amount of capital is $100. The first trade loses 50%, or $50, and leaves an ending balance of $50, to begin the next trade.

Table 1 — The Importance of Managing Losses

The second trade increases by 50%, or $25 and leaves us with an ending balance of $75. The next three trades each make 10%. This gives us a total gain in four trades of 80%… compared to the one loss of 50%. Unfortunately, even with all of this smart trading, we are still a fraction under our starting capital. When we bear in mind that successful traders expect more losing than profitable trades, you can appreciate the 50% loss is pretty difficult to come back from. In this example, we had four winners and one loser, which is way above the norm. You will almost certainly find you make more losing than winning trades, so it is very important to cut losses and let profits run. Whenever you enter a trade you should always ask the questions: What is my likely reward and what is my potential risk? If the reward does not exceed the risk by a comfortable margin the trade should not be executed.

Using Money Management Techniques

Since day trading involves leverage, money management involves the optimum allocation of capital to a margined position. This means you should not put all of your money at risk for one or two trades. Allocate a small amount of capital first and learn to lose money, gaining from that experience in small doses. Once you become more confident in your approach, you can extend the amount of capital at risk a little more, but never more than 10% at a time.

A golden rule of day trading is to take money out of the markets in small amounts—never go for broke and try to make a home run by placing big bets. The reasons for this are: First, this will totally kill you emotionally, causing you to lose the most important element of investment psychology—objectivity. Second, you might win once, or even twice, but eventually the markets will catch up with this “gun slinging” technique and wipe you out.

Excerpted from “Technician’s Guide to Day Trading”

Related Article: Diversification: The Medicine for Sleepless Nights, Part 1