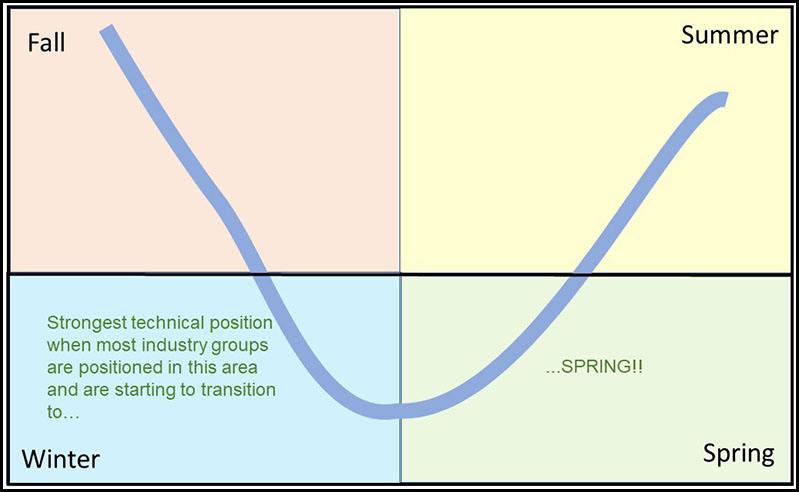

Every cycle effectively goes through four momentum stages before completion. This is shown conceptually in Figure 1 where the curve reflects a theoretical smoothed momentum series. For our purposes, that smoothed momentum is portrayed by a KST indicator, but there is no reason why an MACD or very slow stochastic could not be substituted. The first phase of the cycle occurs after downside momentum has reached its maximum. At this point, the series turns up but is still below its equilibrium level. The second is signaled when it crosses above its zero-reference line. The third phase starts when the momentum series peaks from above zero. Finally, phase 4 is triggered when it crosses below the equilibrium point. For simplicity’s sake, the respective stages have been labeled as spring, summer fall, and winter.

Figure 1 — Long-term Momentum Position

From both an agricultural and an investment point of view, the best results occur when planting (investing) is done in the spring and harvesting in late summer or fall. The significance of a turning point will depend on the type of trend the smoothed momentum series is monitoring. In other words, turning points for momentum calculated from daily data and intended to monitor short-term (3- to 9-week) price movements will not carry the same significance as a monthly derived series calculated to identify primary trend turning points.

Reverting back to our seasons, spring represents accumulation, summer the markup phase, fall distribution, and winter the markdown phase. In situations where a market can be subdivided into components, it’s possible to take this approach one step further by calculating a diffusion index based on the position of the seasonal momentum of its various components, e.g. industry groups for a stock market average, commodity prices for a commodity index, etc. In this article we are focusing on the summer position for industry groups, using the cyclical position of a long-term KST as our benchmark to identify the seasons.

This seasonal momentum approach has two merits. First, it helps to identify the prevailing stage in the cycle, i.e., whether the stock market is in an accumulation, markup, distribution, or markdown phase. Second, it also aids in calling major buying and selling opportunities. One technique for identifying buying opportunities is to spot when the number of industry groups in the summer position bottoms out. That’s because an advancing number of groups in the summer position indicates more and more of them have begun the markup phase.

Chart 1 — The S&P Composite versus Summer Industry Group Momentum 1955 – 2020

Bear Market Bottoms

Generally speaking, the lower the number from which the reversal takes place, the stronger the signal. Buying indications since 1957 are shown by the vertical lines in Chart 1, when the indicator bottomed from a position at, or below, the horizontal line. The dashed lines point out the only real failures in the whole period. Two failed signals against seventeen successes is not bad!

You may notice that in the year 2000, the summer position bottomed at around the same time the S&P was peaking. That was due to the fact that the post mid-1990s rally was narrowly based on the tech bubble. We can also see from the falling summer numbers that the market had been correcting internally for the four years preceding the peak. Consequently, by the time tech topped out, many groups were actually in a position to rally, which they did. The S&P though, sold off because its highly weighted tech component declined quite sharply as the bubble unwound. This was a unique situation, but it does point out that while the diffusion indicator and the indexes usually move in tandem, the diffusion indicator also indicates whether the advance or decline is broadly based or not.

Related Article: Seasonal Breadth Winter Momentum